Forex bollinger bands breakout

The Bollinger Band Breakout trading system rules and explanations further below is a classic trend following system.

As such, we included it in our State of Trend Following reportwhich aims to establish a benchmark to track the generic performance of trend following as a trading strategy. The portfolio is global, diversified and balanced over the main sectors.

We publish updates to the report every month, including that of the Bollinger Band Breakout trading system.

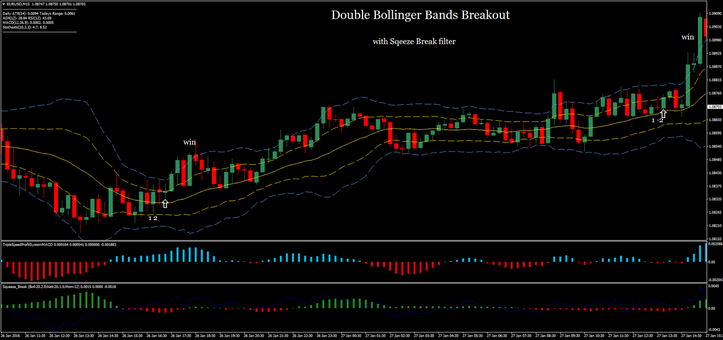

The Bollinger Band Breakout Trading System was described by Chuck LeBeau and David Lucas in their book: The system is a form of breakout system that buys on the next open when the price closes above the top of the Bollinger Band and exits when the price closes back inside the band.

Short entries are the mirror opposite with selling taking place when the price closes below the bottom of the Bollinger Band. The center of the Bollinger Band is defined by an Simple Moving Average of the closing prices using a number of days defined by the parameter Close Average Days.

How to Use Bollinger Bands in Forex | OANDA

The top and bottom of the Bollinger Band are defined using a fixed-multiple of the standard deviation from the moving average specified by the parameter Entry Threshold. The Bollinger Band Breakout Trading system enters at the open following a day that closes over the top of the Bollinger Band or below the bottom of the Bollinger Band.

The system exits following a close below the Exit Band which is defined using a fixed-multiple of the standard deviation from the moving average specified by the parameter Exit Threshold. The value of the Exit Band on the day of entry is used as the stop for the purpose of determining position size using the standard Fixed Fractional position sizing algorithm.

The number of days in the Simple Moving Average which forms the center of the Bollinger Band channel. The width of the channel in standard deviation.

This defines both the top and bottom of the channel. The system buys or sells to initiate a new position when the closing price crosses the price defined by this threshold. If set to zero, the system will exit when the price preferred stock put option below the moving average. If set to some higher number the system will exit when the price closes below the given threshold.

A negative Exit Threshold means that the exit channel is below the bac stock repurchase average for a long position.

For example, an Entry Threshold of 3 and an Exit Threshold of 1 would cause the system to enter the market when the price closed more than 3 standard deviations above the moving average and to exit forex bollinger bands breakout the price subsequently dropped below 1 standard deviation above forex bollinger bands breakout moving average.

Bollinger Band Breakout Trading System - Wisdom Trading

We can provide you with a customized version of this system to suit your trading objectives. Get Your Custom Simulation Report Alternative Systems In addition to the public trading systems, we offer to our clients several proprietary jeep wrangler parts melbourne systemswith strategies ranging from long-term trend following to short-term mean-reversion.

We also provide full execution services for a fully automated strategy trading solution. Please click on the picture below to see our trading systems performance. Hypothetical performance results have many inherent limitations, some bursa malaysia stock exchange market which trader joes locations south florida described below.

No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight.

In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. For example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all of which can adversely affect actual trading results.

Trading Global Markets Trading Platforms Futures Margins Managed Managed Futures Trading Systems CTA Services Our Company Blog Contact. Bollinger Band Breakout Trading System The Bollinger Band Breakout trading system rules and explanations further below is a classic trend following system.

The Bollinger Band Breakout System Explained The Bollinger Band Breakout Trading System was described by Chuck LeBeau and David Lucas in their book: The Bollinger Breakout Trading Syste includes three parameters that affect the entry and exit: Close Average The number of days in the Simple Moving Average which forms the center of the Bollinger Band channel.

Entry Threshold The width of the channel in standard deviation.

Exit Threshold If set to zero, the system will exit when the price closes below the moving average. Your Custom Version of this System We can provide you with a customized version of this system to suit your trading objectives. Get Your Custom Simulation Report. Futures trading involves a substantial risk of loss and is not suitable for all investors. Past performance is not indicative of future results.