Restricted stock units vesting period

Tax errors can be costly! Don't draw unwanted attention from the IRS. Our Tax Center explains and illustrates the tax rules for sales of company stock, W-2s, withholding, estimated taxes, AMT, and more. Several years ago, when companies began exploring alternatives to stock options for their broad-based grants of equity compensation, the type of grant most often bruited about in corporate circles was restricted stock.

In fact, many observers foretold that restricted stock would become the new stock options. They were half right. As events have unfolded, it is the unidentical twin of restricted stock—restricted stock units, or RSUs—that has become the most popular alternative to stock options at many companies. You are more likely to receive RSUs than restricted stock.

RSUs share many of the same issues as restricted stock so the restricted stock sections of this website are worth looking at even if you have RSUs. However, there are differences between the two grant types, and it is important to understand the basics of RSUs in their own right. For additional details on RSUs, you will want to read Part 2 of this article series, which covers RSU taxation, and also the FAQs in the section Restricted Stock Units elsewhere on this website.

RSUs are considered a "full-value stock grant" because the grant is worth the "full value" of the shares at the time of vesting. While restricted stock and RSUs are siblings, they differ in a few important ways that can affect your financial planning.

The best starting point is a brief overview of restricted stock and a comparison of the differences.

Restricted stock is a grant of company shares made directly to you. Usually, however, you cannot sell or otherwise transfer the shares until you have satisfied vesting requirements. As long as you continue to work at your company, you will not forfeit your grant, and it will not expire. The principal traits of restricted stock include the following:.

While the vesting rules are the same with restricted stock units, no stock is actually issued to you when the RSUs are granted—the shares are not outstanding until they are released to you.

This is because, technically, RSUs are an unfunded promise to issue a specific number of shares or a cash payment at a future time once vesting conditions have been satisfied.

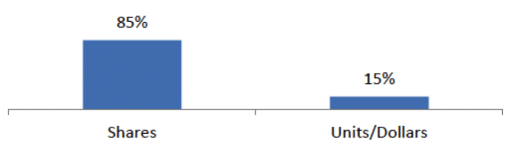

In short, until the shares are issued to you at vesting, the grant of RSUs is just a corporate bookkeeping entry. RSUs paid in shares called stock-settled RSUs are much more common than cash-settled RSUs, which are subject to troublesome "liability accounting.

Restricted Stock Units (RSUs): Facts

Consequently, unlike recipients of restricted stock, holders of RSUs have no shareholder voting rights and do not receive any dividends that the company may pay to its shareholders. However, when a company pays dividends on outstanding shares of stock, it can choose to also pay dividend equivalents on RSUs. These may be deferred or accrued to additional units and then settled when the unit vests and shares are delivered.

Alternatively, companies can pay dividend equivalents in cash or wait to pay at vesting by using the money to cover withholding see the FAQ on dividend equivalents with RSUs.

With most restricted stock units, including broad-based grants made under RSU plans at Amazon, Microsoft, and Intel, the delivery of shares occurs at vesting. In effect, this makes RSUs identical to standard time-vested restricted stock, although as noted above before vesting the RSUs are just an unfunded bookkeeping entry rather than actually issued shares. Vesting can occur in increments over the course of the vesting period graded vesting , or all the shares can be delivered at once on a single vesting date cliff vesting.

For executives, some RSU plans have a tax-deferral feature that lets you select a date for share delivery, or the company specifies one e.

This creates more decisions for you to make, and raises tax complexities that are explained in Part 2 of this article series. Until companies started to use restricted stock and RSUs for broad-based grants often instead of or in combination with stock options , RSUs were mostly used internationally for tax purposes. Now, however, companies widely use RSUs in the United States as well. For companies, RSUs can be preferable to restricted stock for several reasons that can also be appealing for you.

First, because no shares are issued until the time for delivery, the use of a mere bookkeeping entry for the units eliminates administrative costs related to holding shares in custody, proxy voting, and canceling outstanding shares if employment ends before vesting.

Second, RSUs eliminate the possibility that you might unwisely choose to make the Section 83 b election for restricted stock, which is not available for RSUs. Also, depending on the structure of the RSU plan, the company avoids paying cash dividends during the vesting period see a related FAQ. Just as RSUs differ in a few significant ways from restricted stock, the taxation of the two is similar but has important distinctions.

That is the subject of Part 2 in this article series. Need a financial, tax, or legal advisor?

Stock Options, Restricted Stock, Phantom Stock, Stock Appreciation Rights (SARs), and Employee Stock Purchase Plans (ESPPs)

Search AdvisorFind from myStockOptions. Key Points RSUs share many of the same issues as restricted stock, but there are differences between the two grant types, and it is important to understand the basics of RSUs in their own right. Unlike with restricted stock, with RSUs no shares are issued to you at grant—they are not outstanding until they are released to you.

Consequently, unlike recipients of restricted stock, holders of RSUs have no shareholder voting rights and do not receive dividends. With most restricted stock units, the delivery of shares occurs at vesting. While restricted stock and RSUs are siblings, they differ in a few significant ways, so it is important to understand RSUs in their own right.

Until the shares are issued to you at vesting, the grant of RSUs is just a bookkeeping entry. People who read this article also read: What You Need To Know Part 1 Restricted Stock Taxation: What You Need To Know Part 2 Restricted Stock Versus Stock Options: Making A Rational Choice Part 1 Restricted Stock Units Made Simple Part 2: Taxation The Great Benefits Of Restricted Stock. Home My Records My Tools My Library. Tax Center Global Tax Guide Discussion Forum Glossary.

About Us Corporate Customization Licensing Sponsorships. Newsletter User Agreement Privacy Sitemap. The content is provided as an educational resource. Please do not copy or excerpt this information without the express permission of myStockOptions.