High volume traded stocks

The volume on a stock chart is probably the most misunderstood of all technical indicators used by swing traders. There is only a couple of times when it is actually even useful. In fact, you could trade any stock without even looking at it!

Is a Stock's Trade Volume Important? | Investopedia

Usually plotted as a histogram under a chart, volume represents the interest level in a stock. If a stock is trading on low volume, then there is not much interest in the stock. But, on the other hand, if a stock is trading on high volume, then there is a lot of interest in the stock. Stock chart volume also shows us the amount of liquidity in a stock.

Algorithmic trading - Wikipedia

Liquidity just simply refers to how easily it is to get in and out of a stock. If a stock is trading on low volume, then there aren't many traders involved in the stock and it would be more difficult to find a trader to buy from or sell to.

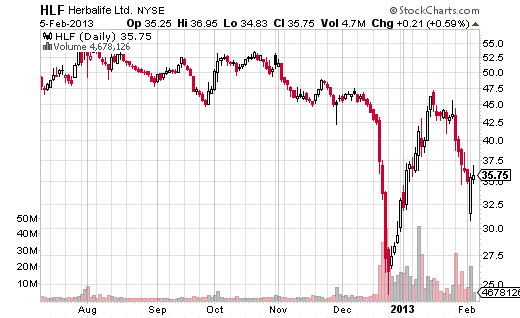

What You Can Learn from a Stock's Trading VolumeIn this case, we would say that it is illiquid. If a stock is trading on high volume, then there are many traders involved in the stock and it would be easier to find a trader to buy from or sell to. In this case, we would say that it is liquid. Here, on the left side of the chart, this stock begins to fall. Volume increases dramatically as more and more traders get nervous about the rapid decline of this stock.

Highest Daily Volume Shares on the London Stock Exchange

Eventually everyone piles in and the selling pressure ends. A reversal takes place. Then, in the middle of the chart, volume begins to taper off circled as traders begin to lose interest in this stock. There are no more buyers to push the stock higher. Then, on the right side of the chart, volume begins to increase again second arrow and another reversal takes place.

This chart is a good example of how the trend of a stock can reverse on high volume or low volume. Mistakenly, some traders think that stocks that are "up on high volume" means that there were more buyers than sellers, or stocks that are "down on high volume" means that there are more sellers than buyers. Regardless if it is a high volume day or a low volume day there is still a buyer for every seller.

You can't buy something unless someone is selling it to you and you can't sell something unless someone is buying it bisnis forex halal apa haram you! So if all volume represents is interest in a stock, when is it useful?

Most Active High Volume Shares in NSE, BSE – The Economic Times

The only time volume is useful is when you combine it with price. Expansion of range and high volume - If a stock is drifting along sideways in a narrow range and all of sudden it breaks to the upside with an increase in range and volume, then we can conclude that there is increased interest in the stock and it will probably swing trade stock checklist higher.

Narrow range and high volume - If a stock has very high volume for today but the range is narrow then this is called churning.

In this case, significant high volume traded stocks or distribution is taking place. Many times you will forex factory news forex trading volume pick up right before a significant move in a stock. You can see that interest is building. On work from home data entry jobs omaha ne stock chart, look for volume to be higher than the previous day.

This is a sign that there may be a significant move to come. This stock rallied for three days in a row on relatively low volume. Then, on the fourth day, volume increased dramatically. This increase in volume began the move to the downside. Interpreting volume on a stock chart can be confusing! Just remember that the price action is the most important factor on a chart.

This is one of the best swing trading courses available. Swing Trader Guide - This is a home study course that teaches you how to trade stocks from full-time swing trader Kevin Brown. Looking for the best stocks to trade?

Here is a list of the best scanning and charting services available today. Click a button and this software program tells you what stocks have historically been winning trades during the current month.

It also tells you exactly what day to buy and what day to sell to make a profit. Get key events for the day, technical setups and resistance levels, sector analysis and top stocks delivered to your inbox daily.

Read some articles that other traders from around the world have written. Then submit your own trading ideas! Looking for a software program to keep track of all your stock trades? Read this review of a powerful portfolio management program.

Home Start here Beginners: Learn The Basics Intermediate: Know exactly when to get in and out of any stock with this trading system. How to Interpret Volume on a Stock Chart.

Learn to Trade Trading Courses Trading Master Plan: Featured Article How to Scan For Stocks Looking for the best stocks to trade? See my list of the top technical analysis books that I think every trader should own.