Stock market trailing stops

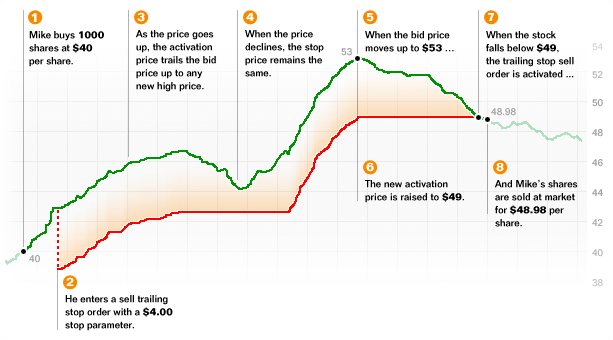

A trailing stop limit order is designed to allow an investor to specify a limit on the maximum possible loss, without setting a limit on the maximum possible gain.

A SELL trailing stop limit moves with the market price, and continually recalculates the stop trigger price at a fixed amount below the market price, based on the user-defined "trailing" amount.

The limit order price is also continually recalculated based on the limit offset. As the market price rises, both the stop price and the limit price rise by the trail amount and limit offset respectively, but if the stock price falls, the stop price remains unchanged, and when the stop price is hit a limit order is submitted at the last calculated limit price.

Trailing Stop Orders | Interactive Brokers

A "Buy" trailing stop limit order is the mirror image of a sell trailing stop limit, and is generally used in falling markets. IB may simulate stop-limit orders on exchanges.

For details on how IB manages stop-limit orders, click here. The Reference Table to the upper right provides a general summary of the order type characteristics. The checked features are applicable in some combination, but do not necessarily work in conjunction with all other checked features. For example, if Options and Stocks, US and Non-US, and Smart and Directed are all checked, it does not follow that all US and Non-US Smart and direct-routed stocks support the order type.

It may be the case that only Smart-routed US Stocks, direct-routed Non-US stocks and Smart-routed US Options are supported. You set a trailing stop limit order with the trailing amount 20 cents below the current market price of The trailing amount is the amount used to calculate the initial stop price, by which you want the limit price to trail the stop price.

To do this, first create a SELL order, then click select TRAIL LIMIT in the Type field and enter 0. In a trailing stop limit order, you specify a stop price and either a limit price or a limit offset. In this example, we are going to set the limit offset; the limit price is then calculated as Stop Price — Limit Offset.

You enter a stop price of You submit the order. You transmit your order. The market price of XYZ continues to drop and touches your stop price of A limit order to sell shares of XYZ at IB SM , InteractiveBrokers.

Using Trailing Stop Orders with Your Online Broker - ykewobuzyjeca.web.fc2.com

Supporting documentation for any claims and statistical information will be provided upon request. Any trading symbols displayed are for illustrative purposes only and are not intended to portray recommendations. The risk of loss in online trading of stocks, options, futures, forex, foreign equities, and bonds can be substantial. Options involve risk and are not suitable for all investors. Before investing in options, read the "Characteristics and Risks of Standardized Options".

For a copy visit http: Before trading, clients must read the relevant risk disclosure statements on our Warnings and Disclosures page - http: Trading on margin is only for sophisticated investors with high risk tolerance. You may lose more than your initial investment. For additional information regarding margin loan rates, see http: Security futures involve a high degree of risk and are not suitable for all investors.

The amount you may lose may be greater than your initial investment. Before trading security futures, read the Security Futures Risk Disclosure Statement. There is a substantial risk of loss in foreign exchange trading. The settlement date of foreign exchange trades can vary due to time zone differences and bank holidays. When trading across foreign exchange markets, this may necessitate borrowing funds to settle foreign exchange trades.

Trailing Stop-on-Quote Orders | Scottrade

The interest rate on borrowed funds must be considered when computing the cost of trades across multiple markets. One Pickwick Plaza, Greenwich, CT USA www. Is a member of the Investment Industry Regulatory Organization of Canada IIROC and Member - Canadian Investor Protection Fund. View the IIROC AdvisorReport.

Trading of securities and derivatives may involve a high degree of risk and investors should be prepared for the risk of losing their entire investment and losing further amounts. Interactive Brokers Canada Inc. Level 40, Grosvenor Place, George Street, Sydney , New South Wales, Australia. LIMITED is authorised and regulated by the Financial Conduct Authority. FCA register entry number Level 20 Heron Tower, Bishopsgate, London EC2N 4AY www. Suite , Two Pacific Place, 88 Queensway, Admiralty, Hong Kong SAR www.

Trader Workstation TWS Latest TWS TWS Beta Account Management Account Management Finish an Application. WebTrader WebTrader WebTrader Beta API Access IB Gateway Latest IB Gateway. PortfolioAnalyst Beta - NEW.

How to Choose and Configure an Account Continue or Finish Your Application. Home Home Individual Investor or Trader Registered Investment Advisor Hedge or Mutual Fund Money Manager Proprietary Trading Group Family Office Small Business Friends and Family Advisor Introducing Broker Incentive Plan Administrator Compliance Officer Administrator Educator Referrer.

Overview Commissions Interest and Financing Research, News and Market Data Institutional Research Required Minimums Other Fees Advisor Fees Broker Client Markups IB Feature Explorer. IB Feature Explorer Browse all the advantages of an IB account.

ABOUT US Information and History Awards News Media Live Events Investor Relations MORE Client Services Institutions Client Services Institutions Sales Contacts Trading Desks IB Knowledge Base System Status IB Feature Explorer. Trailing Stop Limit Orders.

Products Availability Routing TWS Bonds US Products Smart Attribute CFDs Non-US Products Directed Order Type EFPs Time in Force Forex Futures FOPs Options Stocks Warrants Open Users' Guide.

Example Order Type In Depth - Trailing Stop Limit Sell Order. Step 2 — Order Transmitted You transmit your order.

Assumptions Avg Price Step 5 — Market Price Touches Stop Price, Limit Order Submitted The market price of XYZ continues to drop and touches your stop price of Investors' Marketplace Investor Relations Careers Site Map System Status. Privacy Notice Forms and Disclosures Customer Identification Program Notice Cyber Security Notice IB SM , InteractiveBrokers.