How to calculate a stocks fair market value

Help you to determine the acceptable purchase price of a stock based on your required rate of return. This free online Stock Price Calculator will calculate the most you could pay for a stock and still earn your required rate of return -- all based on the current dividend and the historical growth percentage.

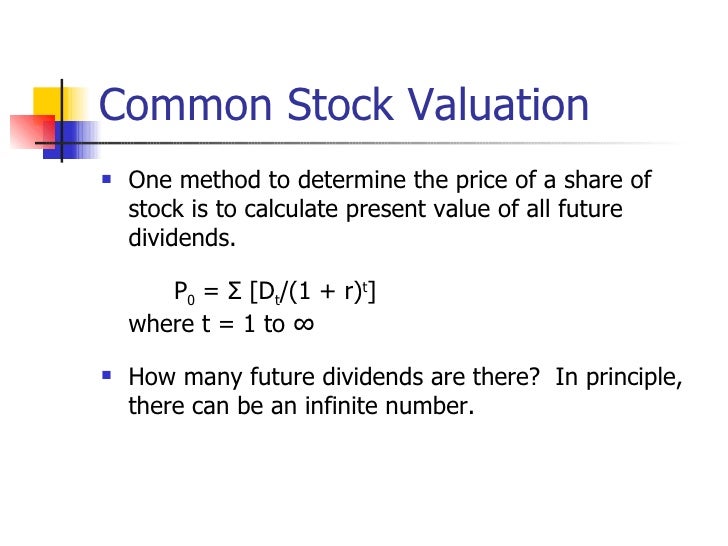

Plus, as of August 4, , the calculator also shows its work step-by-step display showing how it arrived at the stock price. The common stock valuation formula used by this stock valuation calculator is based on the dividend growth model , which is just one of several stock valuation models used by investors to determine how much they should be willing to pay for various stocks. The dividend growth model for common stock valuation assumes that dividends will be paid, and also assumes that dividends will grow at a constant pace for an indefinite period of time.

Of course, neither of these assumptions rarely, if ever, occur in real life. Unlike bonds, where the risk of principal loss is minimal and dividends are paid on a fixed percentage, stocks come with an increased risk of losing your principal and stock dividends are never guaranteed and the dividend per share is not fixed. These added risks and uncertainties of investing in stocks explains why investors expect to earn a better return on investment on stocks than they do on bonds.

In other words, more risk equates to a higher expected rate of return. This difference between a low-risk expected rate of return such as the T-Bill rate , and the higher expected rate of return that comes from increased risk is often referred to as the risk premium.

Risk premium can be thought of as the percentage that would need to be added to a risk-free return on investment in order to entice an investor into investing in the risky investment being offered.

Once this percentage is added, the result is referred to as the required rate of return. With that, let's use the Stock Price Calculator to calculate the maximum price you could pay for a given stock and still earn your required rate of return. Enter the dividend price, the growth rate, and the expected rate of return, then click the "Calculate Stock Price" button.

If you don't know the growth rate, you can calculate it using the Stock Growth Rate Calculator opens in a new window. Mouse over the blue question marks for a further explanation of each entry field.

More in-depth explanations can be found in the glossary of terms located beneath the Stock Price Calculator.

Watch the Video Tour to see what you're missing! JavaScript is turned off. You will need to enable it to use this javascript-based calculator. Please try disabling Ad Block for this page, as it may be blocking the code that runs the calculator.

Chances are, if the calculator is not working at all, you may be missing out on other content on the web due to an outdated or non-conforming web browser. All calculators have been tested to work with the latest Chrome, Firefox, and Safari web browsers all are free to download.

I gave up trying to support other web browsers because they seem to thumb their noses at widely accepted standards. This field should already be filled in if you are using a newer web browser with javascript turned on. If the calculator is not working for you, this information will help me to find and fix the problem.

How Is the Fair Market Value of Stock Determined? -- The Motley Fool

Stock Price Calculator Glossary of Terms. Current dividend per share: Enter the current dividend per share. Enter the calculated growth rate. Please enter as a percentage for. If you don't know the growth rate percentage, you can easily calculate it using my Growth Rate Calculator opens in a new window. Required rate of return: Enter the required rate of return. This is often arrived at by adding a percentage for risk premium to the T-Bill rate. Note that the required rate of return must be greater than the stock growth rate in order for the dividend growth model to be used for common stock valuation.

Based on your entries, this is the maximum price per share you could pay and still earn your required rate of return. The process of determining the maximum price you should pay for various stocks based on your required rate of return -- using one of several stock valuation models. The stock price calculator uses the dividend growth model to calculate price.

Got some time to increase your financial happiness? Why use a present value annuity table when you can calculate it here. Debt investment return calculator - Wow! Rapid payoff calculator for debt reduction at break-neck speed! In return for your vote of confidence I promise to continue working hard to earn your return visits.

Follow me on any of the social media sites below and be among the first to get a sneak peek at the newest and coolest calculators that are being added or updated each month. Who knows if I will show up in your next search. This will insure you'll always know what I've been up to and where you can find me!

Stock Price Calculator for Common Stock Valuation

Dan Peterson , Free-Online-Calculator-Use. Free Online Financial Calculators: Other Free Online Calculators: Home What's New Contact About Disclaimer Privacy Policy Site Map Site Search Site Ad Policies. Please grade my work and help me improve: Check Out My Other Super Investment Calculators To Help You To Calculate Your Why use a present value annuity table when you can calculate it here Debt investment return calculator - Wow!

Ad-Free Member Version Benefits. Top Ten Home Money Calculators. Net Paycheck Hourly to Salary Overtime Pay Extra Mtg Payment Salary to Hourly Pay Raise Sales Tax Percent Off Snowball Payoff Car Buying Newest: Monthly What's New Email Update!

Please note that all fields preceded by a red asterisk must be filled in. A , please tell me what I would need to do to the calculator to get an A.

D - Poor, did not provide me with the solution I was hoping for. F - Fail, didn't work, inaccurate, should cost less than "free".

Please tell me what you entered so I can track down and fix the problem. Have a question about the calculator? Enter it below and be sure to include your first name and a valid email address.

Please click the button one time only , it may take a moment to submit.