Swing low forex

Did you know that something as simple as knowing where the current Swing High and Swing Low is on a given chart has massive implications on your success as a trader? A Swing High, Swing Low SHSL is a piece of price action where multiple candle sticks or bars are grouped together and considered to be part of one move in a certain direction.

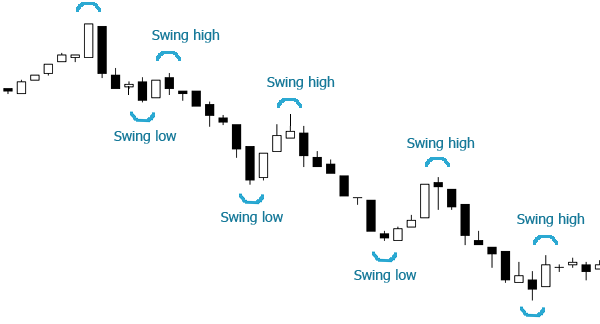

The Swing High is, of course, the highest price of the given move and likewise, the Swing Low is the lowest price of the given move. When the market makes two consecutive higher highs and higher lows or two consecutive lower lows and lower highs, we consider it a swing.

Swings come in all different shapes and sizes, but you can identify them all by using the simple rule about consecutive higher highs and higher lows or vice-versa. Here, you can see a typical Bullish Swing. Notice that we have two consecutive higher highs and higher lows: Again, both new highs and lows are moving down: That was simple, but what about when price is moving up and down and making non-consecutive highs and lows?

Just remember that if there is a lower low in the midst of an bullish swing, it continues to remain bullish until there are consecutive lower lows and lower highs. Take a look at this example: Bullish swings are colored blue and Bearish swings are colored red. Notice toward the end of the swing, there is a surge down where a lower low is created, but there is not a consecutive lower low after that so it remains a Bullish Swing.

And those continue to count as one swing until a separate swing forms in the opposite direction. Many times the market will make a new high in the midst of a downtrend, but this is just a fake and does not mean anything to us unless there is a higher low after the new high and then another new higher high.

Notice that the market surged up to make a new high, but it was followed by a new low in the midst of a downtrend, so we ignore that high and include it as part of the bearish swing. Always pips below the low of the bullish swing for a buy and above the high of the bearish swing for a high. The DTT Method is a great strategy based on trend continuation.

Identifying the correct swing with this strategy has huge implications. The DTT strategy looks for counter-trend moves, then draws a trend line on the counter-trend structure and waits for the break back into the direction of the trend.

Because we know the correct Swing, we can draw a Fib and put our Target a few pips inside the I simply draw the Fib from the swing low to the swing high and then place my target just inside the Now, we wait and see. As you can see, the market surged right down to our extension level and stopped.

Though not all trades will work out perfectly like this example trade, this is a fairly common occurrence. In cases like this, picking the right Swing is of HUGE importance. Many traders might simply grab the entire Bearish move on the chart as the recent swing I have seen this a lot to draw their Fibonacci Extension.

The problem is that, by doing so, they have dramatically reduced the chance that the trade will now hit their target. Just increasing your win rate by a tiny amount assuming all else remains equal can completely reverse your results as a trader. I hope this article illustrates the connection between identifying Market Swings correctly and the ability to win a high percentage of your trades.

If you use this article as a resource and take advantage of this lesson, you will see a boost in your win rate immediately! It should look something like this: Take a screenshot of the identified swings and submit it in the comments below this article. Thanks for the article.

Unfortunately print screen on my computer is not working. I hope to attend to this soon. Have a nice weekend! I will join in with my contribution for the mentioned excercise. The brown circles indicate what I consider to be the swing highs and swing lows. I consider the bottoms and tops that do not have a circle to be part of an ongoing swing high and swing low.

How Identifying the Right “Swing” will Boost your Win Rate and Your Profit | Winners Edge Trading

If anyone has questions, please let me know. Hey Dave, thanks for the feedback! The EURNZD looks like a bearish swing to me too. Someitmes the momentum can be strong indeed. Thanks Ron for the feedback and post! Yes indeed — that upside was a corrective swing, then followed by an impulsive swing. Do you want to post a chart as well?

Hello Thumper, great job on your screenshot. Candle stick patterns help spot the turning moment and I can see that all of your swings make sense. Hello Josh, thank you too for taking the time to learn via this excercise! It is a great that you took out the time to complete this. You did an excellent job! All the swings shown in this screenshot make sense to me. Hi Jordan, great job with the screenshot. We appreciate the fact that you took the time to learn via this excercise.

On top of that, you provided excellent work! In my opinion most of the squares you drew on the chart are important tops and bottoms, although not all of them I would consider vital. When looking for swings we want to focus on the key tops and bottoms. For instance, the 4th square from the right I would not consider a swing bottom because the move still continues lower before it faces a lower high. I see that the larger, over all trend was down and that the set up to go short was on a pullback….

There still were higher highs and higher lows… So why did you have a set up to go short?

How to Identify and Trade Market Swings

Secondly, what happens when you have a continuous run of higher highs with no lows in between, or vice versa. For example, according to your definition, the period from June 4 to the present June 18 on the EURNZD daily chart would not constitute a bearish swing, because there are no lower highs in it.

Trading forex on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose.

You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts. Home Blog Tools Pricing BROKER About Us Were Hiring Contact Us! How Do We Identify the Correct Swing? Using the Correct Swing to Increase Profit: Now that you know how to identify the correct swing on a given time frame, you can use that information to increase your win rate and your profit.

How Identifying the Right “Swing” will Boost your Win Rate and Your Profit | Winners Edge Trading

The following two tabs change content below. Winners Edge Trading was founded in and is working to create the most current and useful Forex information and training available on the internet. Latest posts by admin see all. Hi this is my homework, it was an excellent article Nathan. Hi Nathan, Thanks for the article.

I liked to opportunity to discipline myself to identify the swings and this was good practice. Congratulations to the author. Thanks Nathan for the excellent article! I am looking forward to see the charts of many more!! I am looking forward to see the charts of many more! Thanks for the post and screenshot, great job!

Bullish and Bearish swings on the EURUSD. Here is my take. Popular Views Hot Off The Press Most Commented Popular Trading Volume In Forex, a must needed guide Long Term Trading Strategy for Forex NFP Trading in Forex and a strategy for trading Creating a Forex Trading System: Long Term Trading Strategy for Forex Creating a Forex Trading System: Success Tips Forex Trading: Home Contributors Site Map Privacy Policy Legal Disclaimer Terms and Conditions.

Enter your email here: DOUBLE TREND TRAP STRATEGY. Do You Need a Profitable Trading Strategy? Where Should We Send you Our Double Trend Trap Strategy?

Now Take your trading to the next level by taking our trading quiz to pinpoint your strengths and weaknesses. NO THANKS I DONT NEED TO IMPROVE MY TRADING IN ANY WAY.