Straddles options strategies

There are hundreds of option strategies.

And they can be vastly different in terms of tactics and desired outcomes. But in fact, there are really only a few basic strategies, and everything else is built on these in some form. This range of possible strategic designs is what makes the options market so interesting, challenging, profitable Well, "risk" and "opportunity" are really the same thing, and every option trader needs to accept this.

Straddle - Wikipedia

Because if you want to go fast and get some serious movement, well, you have to climb on board the rollercoaster first, even if it scares you a little bit. In my last options trading strategies article I took the mystery out of long calls, long puts, covered calls, short puts and insurance puts.

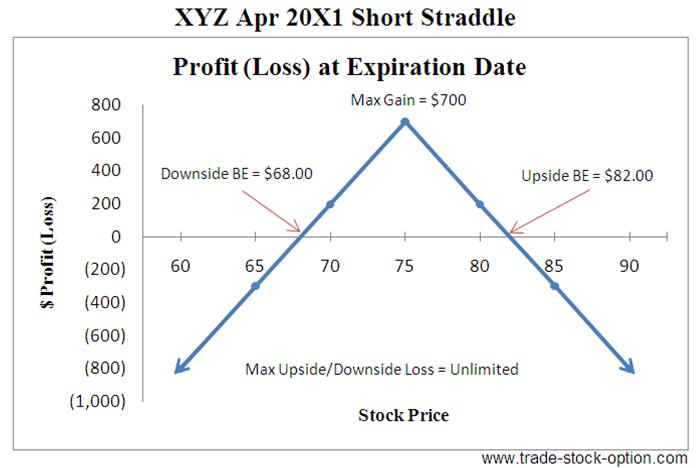

But the truth is those are only five of the eight general strategies and "families" of strategies we use here At Money Map Press. Today I'd like to tell you about the final three, explaining what you need to know about Leaps, spreads, straddles.

This strategy can be an attractive alternative to the otherwise very short lifespan of most options. And the potential for gains in either long or short Leaps trades is substantial. The Leaps, or long-term equity appreciation securities contract, is simply a long-term option. They are available, as calls and puts, on 20 indexes and approximately 2, equities.

The life span of a Leaps option is as long as 30 months. In the options world, that is something akin to "forever. Leaps provide a lot of interesting strategic possibilities. You can open long Leaps call positions as a "contingent purchase" strategy, so shares can be bought in the future. Or you can buy puts as insurance or as contingent sales positions.

The big disadvantage of a long-term option is going to be the very high time value — you have to pay for the luxury of a long-term play.

Long Straddle Strategy | Options Trading at optionsXpress

This is true, at least, if you buy long-term contracts. But if you sell them instead, that high time value works in your favor. That's why my favorite way to play the LEAPS is to sell an ATM call.

Your return can be significant. And the premium provides a cushion that makes LEAPS sales very desirable, especially if it's part of a long-term contingency plan. If you are willing to sell shares at a specific price at any time between now and two years from now, selling a LEAPS option brings in high current income and a desirable exposure to exercise.

In mid-February, shares of Google Inc. The January call was trading at If you sell that call, that's a In that case, the premium value of the call would decline, and you could close your position for a nice profit. Next, I'm going to explain the basics of spreads and straddles. That's where the hedging potential of these combined strategies comes in We asked traders what FBI Director Comey's testimony means for stocks and other markets.

Silver holding huge commercial short. Retail is in trouble because of economic conditions. What does this mean for the markets?

Election play in gold options. Are you surprised by my characterization of risk as "nice? Let's get started with Leaps. Understanding Leaps Options This strategy can be an attractive alternative to the otherwise very short lifespan of most options.

Let me show you how this works. Page 1 of 2. Commodities firm, silver may be at major turning point. Will geopolitical concerns ignite crude market? Oil prices lifted by expected fall in U.

Money A2Z

The Chinese Yuan Hits Year High. Good for Gold but Bad for the Economy. Thomsett 7 versatile tools 2 At Money Map Press 1. Previous The Chinese Yuan Hits Year High. Related Terms Google Inc.