Trading strategies in the sovereign cds market

Please note that Internet Explorer version 8. Please refer to this blog post for more information.

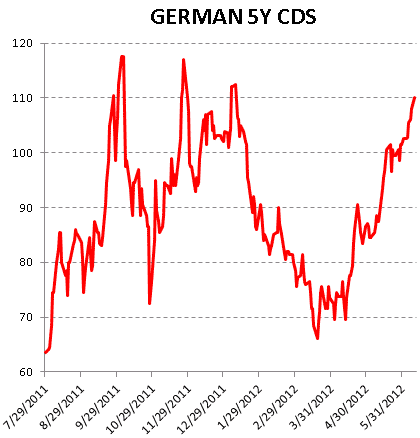

We document sizable deviations from parity during the euro area sovereign crisis. Funding frictions and bond illiquidity partly explain negative basis deviations.

Hughes Optioneering

We compare the market pricing of euro area government bonds and the corresponding Credit Default Swaps CDSs. Our sample of weekly data covers the period from January to December and contains several episodes of sovereign market distress. Overall, we observe a complex relationship between the derivatives market and the underlying cash market characterised by sizable deviations from the no-arbitrage relationship i.

We show that short-selling frictions explain the persistence of positive basis deviations while funding frictions explain the persistence of negative basis deviations which are observed for countries with weak public finances.

We also thank participants in the ECB DG-Research seminar , the CREDIT Greta conference in Venice , the EFMA conference in Braga-Portugal , Second International Conference on Sovereign Bond Markets ECB-SAFE-NYU hold at the European Central Bank in Frankfurt and European Commission JRC , Economic and Financial Analysis Unit research seminar series , and two anonymous reviewers.

This research was partly developed when Alessandro Fontana was a Researcher at the Geneva Research Finance Institute University of Geneva. First draft of the paper: The opinions in this paper do not necessarily reflect those of the ECB, the SSM or the Eurosystem.

The People's Cube - Political Humor & Satire

Journals Books Register Sign in Sign in using your ScienceDirect credentials Username. Forgotten username or password? Sign in via your institution OpenAthens Other institution Recent Institutions.

Smashing Interviews Magazine | Compelling People — Interesting Lives

Sign in using your ScienceDirect credentials Username. JavaScript is disabled on your browser. Please enable JavaScript to use all the features on this page.

Author links open the author workspace. Opens the author workspace Opens the author workspace a. Numbers and letters correspond to the affiliation list. Click to expose these in author workspace 1. Click to expose these in author workspace Martin Scheicher. Opens the author workspace b. Click to expose these in author workspace 2. Click to expose these in author workspace a European Commission, Joint Research Centre, Financial and Economic Analysis Unit IPSC , Italy b European Central Bank, Sonnemannstrasse 20, D Frankfurt am Main, Germany.

Under a Creative Commons license. Abstract We compare the market pricing of euro area government bonds and the corresponding Credit Default Swaps CDSs.

Published by Elsevier B. Elsevier About ScienceDirect Remote access Shopping cart Contact and support Terms and conditions Privacy policy. Cookies are used by this site. For more information, visit the cookies page.