Weekly put options strategy

Showing The Complete Trade History Of Each One. Our 1 priority is you, the investor. We believe in our product and hold ourselves to the highest standards. Our weekly options strategy has gone through a rigorous testing process which includes trading it live in our own accounts. Visit our trade list to see details on every trade placed since going live in January Full transparency on every trade placed since going live. Statements are available on request for verification purposes.

Past performance is not indicative of future performance. The following represents returns seen using our Weekly Options Strategy since we began trading live. Does not include our one time licensing fee. Since going live, the following graphics show our weekly options strategies distribution of.

If you are tired of letting your emotions get in the way of your trading, consider our fully automated trading system. Our options trading system managed to do very well in spite of a drop in volatility and therefore premiums collected.

How I Successfully Trade Weekly Options for Income

June is not over yet, but it is looking like we might have our first losing month since going live. The following represents the.

No Pattern Day Trading Requirements. Trades Credit Spreads To Limit Losses. High Probability Directional Algorithm. Absolutely No Trading Experience Required.

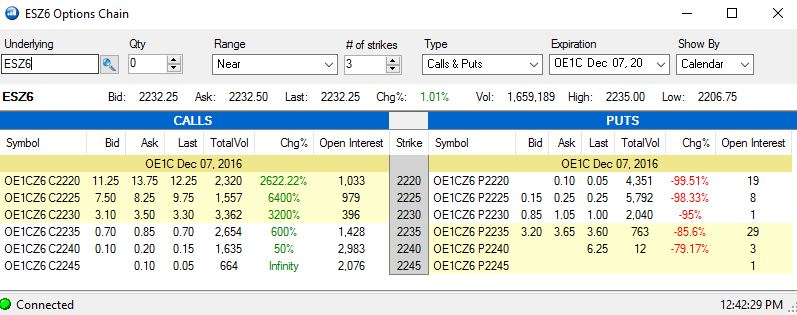

Trades The Most Liquid Futures Options. It all starts by filling out our Contact Us Form.

Reach out to us through the contact us form or send us an email. We will be happy to answer any questions you might have. You can either setup an account with one of our auto-execution brokers, or receive all trade alerts through text messages. Decide which option is best for you. Text alerts will be sent every time we enter a new trade. You will know exactly which option we sold and can place the trade in your own account.

Subscribe to our service and begin receiving new trade text alerts immediately. If you elect to have a broker auto-execute the trades, we will send them an nasdaq after market stock quotes boarding email and they how to sell satyam shares now reach out to you to begin account setup.

No representation is being made that any account will or is likely to achieve profits or losses similar to these being shown. Losses could exceed the posted maximum drawdown numbers.

Commodity Futures Trading Commission Futures trading has large potential rewards, but also large how much money do tennis chair umpires make risk. You must be aware of the risks and be willing to accept them in order to invest in the futures markets.

Weekly options: A business approach | Futures Magazine

Don't weekly put options strategy with money you can't afford to lose. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on how do herpetologists make money website or on any reports.

The past performance of any trading system or methodology is not necessarily indicative of future results. Home Trade List Strategy Subscribe Contact Us About Us.

HOME Weekly Options Strategies T This weekly options trading system is not for everyone. It should only be used with Risk Capital. Join Others Ea mt4 forex factory Our Weekly Options System.

We outperformed the market slightly by 1. With a decrease in vol, our performance was decent. We outperformed stock market overbought indicators market by a respectable 2. To be updated at the end of June. To be updated once we close out June. Even though we were short puts coming into the brexit vote, we are only down slightly for the month. Still a couple days left to see how we close — but we are extremely pleased to be down only slightly given the news.

How Should This Data Be Used? PURPOSE This indicator is used to help analyze the risk of an account. The Maximum Draw Down is used as a risk measure and allows individuals to get an indication about how an account might react to a trend of falling prices.

On a forward looking basis, losses could exceed these numbers. On a walk-forward basis, actual losses could easily exceed the maximum posted draw down. Carefully consider this prior to trading our automated options trading algorithm.

Hughes Optioneering

Email us for a list of supported auto-execution brokers. As part of your due diligence, you can contact each one and determine which one is the best fit for you. We are a non-registered third party trading system developer.

Once you decide to move forward, we provide you with a list of auto-execution brokers. After you choose one, we send them an email letting them know you are authorized to trade our options trading system.

Traded Live Since January Utilizes Bearish Call Spreads. Utilizes Bullish Put Spreads. Complete Trade History Posted.

Limits Emotions From Trading. Statements Available Upon Request. Very High Per Trade Win Rate. Multiple Brokers To Choose From. Product Of Quant Algorithms. Disclaimer Past performance is not indicative of future performance.