409a compliant stock options

Connecting decision makers to a dynamic network of information, people and ideas, Bloomberg quickly and accurately delivers business and financial information, news and insight around the world. A cookie is a piece of data stored by your browser or device that helps websites like this one recognize return visitors. We use cookies to give you the best experience on BNA. Some cookies are also necessary for the technical operation of our website. For even more information, see Privacy Policy: Our Policies Regarding the Collection of Information.

Forgot your username or password? An integrated legal research and business intelligence solution, combining trusted news and analysis with cutting-edge technology to provide legal professionals tools to be proactive advisors.

Combines powerful, easy-to-use, compliance tools, auditing software, and analysis with continuously updated federal and state laws, regulations, and documents. Your HR and Payroll compliance and policy solution! Comply with federal, state, and international laws, find answers to your most challenging questions, get timely updates with email alerts, and more with our suite of products.

United States, 1 the Court of Federal Claims confirmed that Section A applies to a discounted stock option when it ruled in favor of the United States on several key issues determined on summary judgment. We provide below a summary of the relevant Section A rules and the recent development in Sutardja, along with a few general observations.

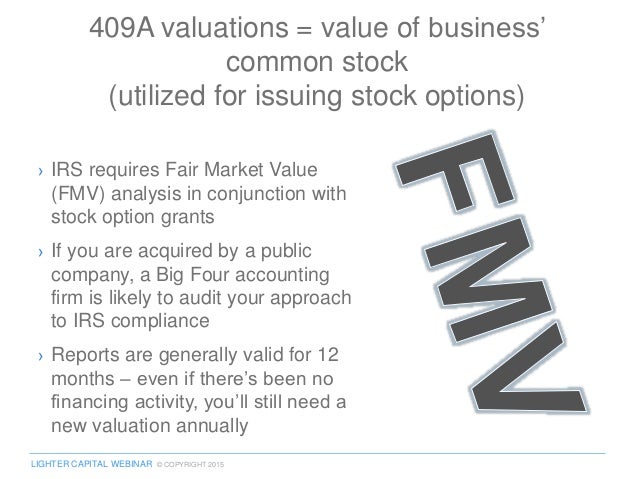

Section A was enacted in as part of the American Jobs Creation Act. Deferred compensation under Section A is defined to include, unless an exception applies, any right to a payment in a future tax year. Typically, a nonqualified stock option is structured to be exercisable during its term at any time after vesting, and upon exercise, the option holder recognizes income equal to the difference between the exercise price and the fair market value of the underlying stock on the exercise date.

Due to this ability to exercise in more than one year, a stock option that is subject to Section A generally will not be compliant. If the requirements of Section A are violated, all amounts deferred by the participant under that type of plan 6 e.

Fortunately, Section A specifically provides an exception from its definition of deferred compensation for stock options that meet certain requirements. Essentially, the grant of a nonstatutory stock option also known as a nonqualified stock option is exempt from Section A if, among other requirements, the exercise price may never be less than the fair market value of the underlying stock on the grant date.

The CEO exercised a portion of this stock option in January , which was followed by an internal review of the Company's stock option granting practices.

In , the CEO and his wife Plaintiffs received a Notice of Deficiency from the IRS for the tax year, assessing the Adverse Tax Consequences for a Section A violation in connection with the stock option exercise. The Notice of Deficiency was based on the IRS assertion that the exercise price for the stock option was lower than the share price on the Jan. The outcome of this case remains undecided because the court has yet to rule on the factual issue of whether the exercise price was below fair market value on the grant date.

However, in the process of narrowing the case for trial, the court ruled in favor of the United States on all four of the Plaintiffs' legal arguments for exemption from Section A, as summarized below.

First, the court found that Notice and all subsequent Section A guidance , which provides that discounted stock options are subject to Section A, is consistent with the Supreme Court jurisprudence in Comm'r v. This court noted that Smith did not extend to discounted stock options and thus, the application of Section A to a discounted stock option pursuant to Notice was not contrary to Supreme Court jurisprudence, as argued by Plaintiffs.

The language of the FICA and Section A regulations are both consistent with the limited applicability of this exclusion. The court disagreed, finding that a legally binding right to compensation arose when the stock option vested.

Finally, the court rejected Plaintiffs' argument that any deferral of income related to the discounted stock option should be exempt from Section A as a short-term deferral under Notice Under the short-term deferral exemption, as set forth in the notice, the terms of the plan must require payment by, and the amount must actually be received, no later than 2 12 months after the year in which the amount is no longer subject to a substantial risk of forfeiture.

Instead, the stock option agreement permitted him to exercise this stock option at any time during its year term. As a result, the court ruled that the short-term deferral exemption was not available to exempt the discounted stock option from Section A. This case is notable for a number of reasons, including that it is the first reported case to address Section A issues regarding discounted stock options and the first reported case in which the government assessed and pursued the Adverse Tax Consequences under Section A.

In addition, we discuss below a few other general observations. The facts in Sutardja are significant due to the period involved.

Employee Stock Options ExplainedThe Company granted these stock options before Section A was even enacted, and the CEO exercised them during the good-faith Section A transition period that lasted through Until now, many practitioners have been operating under the assumption that prior to Jan. However, the government's strict enforcement in light of the Plaintiffs' attempted self-correction and its pursuit of Adverse Tax Consequences under Section A in this case warrants reconsideration on this point.

California applies rules similar to those under Section A to the taxation of nonqualified deferred compensation for state income tax purposes.

The state tax rules can result in an additional 20 percent penalty tax for California residents experiencing a Section A violation. It appears this additional California state tax assessment may be pending the outcome of the underlying factual issues in Sutardja. In the meantime, however, the Plaintiffs have filed a separate suit in California challenging the validity of the California Franchise Tax Board's interpretation of California's Section A piggyback tax rules.

While the court's determination here did not impact the ultimate result, we believe the IRS would identify the grant date not the vesting date as the date a legally binding right to the stock option arises for purposes of A based on Treasury Regulation Section 1. Going forward, based on this added pressure to make grants at fair market value, employers should: Disclaimer This document and any discussions set forth herein are for informational purposes only, and should not be construed as legal advice, which has to be addressed to particular facts and circumstances involved in any given situation.

Review or use of the document and any discussions does not create an attorney-client relationship with the author or publisher.

To the extent that this document may contain suggested provisions, they will require modification to suit a particular transaction, jurisdiction or situation. Please consult with an attorney with the appropriate level of experience if you have any questions. Any tax information contained in the document or discussions is not intended to be used, and cannot be used, for purposes of avoiding penalties imposed under the United States Internal Revenue Code.

Any opinions expressed are those of the author. The Bureau of National Affairs, Inc. Call us for a prepaid UPS label for your return. And, you may discontinue standing orders at any time by contacting us at 1. Returnable within 30 days. Notify me when updates are available No standing order will be created.

Capshare | Cap Table Management

This Bloomberg BNA report is available on standing order, which ensures you will all receive the latest edition. This report is updated annually and we will send you the latest edition once it has been published. By signing up for standing order you will never have to worry about the timeliness of the information you need.

Put me on standing order. Notify me when new releases are available no standing order will be created. This site uses cookies. By continuing to browse the site you are agreeing to our use of cookies. Subscriptions Books Marketing Services Professional Learning. News Insights Newsletters White Papers Videos Podcasts Blogs. Federal Tax State Tax International Tax Estate Planning Financial Accounting. Bloomberg BNA Tax and Accounting. Subscriptions Portfolios Books Marketing Services Professional Learning.

News Newsletters White Papers Videos Podcasts Blogs. Subscriptions Marketing Services Professional Learning Reports.

HR Administration International Human Resources U. News Newsletters White Papers Videos Blogs. ALL PRODUCTS All Products Subscriptions Portfolios Books Professional Learning. About Us Executive Team Media Careers Contact Us.

View From Groom: Discounted Stock Options in the Cross-Hairs of Section A Compliance | Bloomberg BNA

Home Bloomberg Law View From Groom: Discounted Stock Options in the Cross-Hairs of Section A Compliance. Overview Section A was enacted in as part of the American Jobs Creation Act. Section A Rules Deferred compensation under Section A is defined to include, unless an exception applies, any right to a payment in a future tax year.

United States On Dec. Section A Applies to Discounted Stock Options First, the court found that Notice and all subsequent Section A guidance , which provides that discounted stock options are subject to Section A, is consistent with the Supreme Court jurisprudence in Comm'r v.

Short-Term Deferral Exemption Finally, the court rejected Plaintiffs' argument that any deferral of income related to the discounted stock option should be exempt from Section A as a short-term deferral under Notice General Observations This case is notable for a number of reasons, including that it is the first reported case to address Section A issues regarding discounted stock options and the first reported case in which the government assessed and pursued the Adverse Tax Consequences under Section A.

Events Occurred in Good-Faith Period The facts in Sutardja are significant due to the period involved. Potential California State Tax Consequences California applies rules similar to those under Section A to the taxation of nonqualified deferred compensation for state income tax purposes. Next Steps Going forward, based on this added pressure to make grants at fair market value, employers should: His practice focuses on counseling plan sponsors and financial institutions regarding the design and administration of executive deferred compensation plans, equity compensation plans, and qualified retirement plans for public and private companies.

Rose Zaklad rzaklad groom. Her practice focuses on the design and administration of tax-qualified and nonqualified retirement plans. Financial Accounting Estates Gifts and Trusts International Tax State Tax Federal Tax. International Payroll Payroll International Human Resources HR Administration.

STORY ALSO AVAILABLE ON.