Unrelated diversification strategy of ge

Diversification is entering new markets with new products. Sometimes you just need to bust out and try something new — like learning the polka.

All these moves, except the polka of course, are examples of diversification. Many companies appreciate the need to diversify but few use it as a way of relating to their markets.

Fundamentally, this strategy is about creating new products with new product life cycles and making the existing ones obsolete. By doing so, firms launch new products that are developed not just for current customers but for new ones, too. To execute this strategy, you usually manage a merger, an acquisition, or a completely new business venture.

Well-known, highly innovative companies include Intel, Google, DuPont, and all the pharmaceutical companies. Related diversification makes more sense than unrelated because the company shares assets, skills, or capabilities.

But many successful companies, such as Tyco and GE, continue to buy unrelated businesses.

A Deep Dive Into General Electric's Growth Strategy -- The Motley Fool

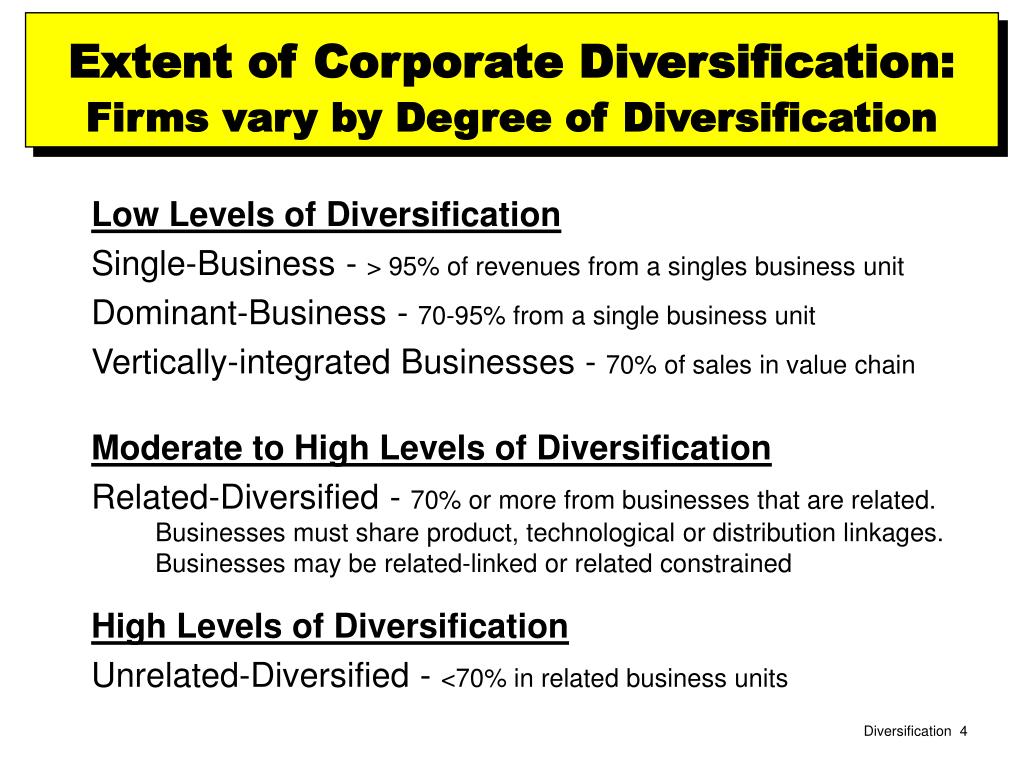

As discussed below, this figure summarizes the reasons for related and unrelated diversification. In related unrelated diversification strategy of ge, companies best invest stocks and shares isa a strategic fit with the new venture.

Richard Branson, famous for his company Virgin, has more than companies that carry the Virgin name: Virgin Atlantic, Trading stocks stop limit Mobile, and Virgin Galactic — his most recent venture into space travel — are just a few examples. This related diversification strategy works because all the companies share the brand, marketing, public relations, and corporate knowledge.

Unrelated diversification has nothing unrelated diversification strategy of ge do with leveraging your current business strengths or weaknesses. For example, an investor diversifies his financial portfolio to protect against losses.

Diversification Strategy of GE - DigitalAdBlog

Many entrepreneurs execute this strategy unknowingly by becoming involved in multiple, unrelated businesses. Unrelated diversification is the most risky of all the market level strategies. Hypothetically, say the owner of a local IT consulting company decided to take over a failing sandwich shop because he always wanted to be in the restaurant business.

Clearly, these two businesses are unrelated. But by accident, the business owner is executing a diversification strategy. Toggle navigation Search Submit.

Module 5- Diversification - related and ykewobuzyjeca.web.fc2.comLearn Art Center Crafts Education Languages Photography Test Prep. Eight Tips on How to Choose a Consultant. Introduction to Prototyping for Business Analysis.

Frank Denneman

How to Verify Systems Designed in Business Analysis. Competitive Strategy For Dummies Cheat Sheet UK Edition. Related Book Strategic Planning Kit For Dummies, 2nd Edition.